Mike Neary, Manager of Horticulture with Bord Bia, shares data from recent market research into the Irish garden market and things are looking positive

Research into the gardening market in 2014 carried out by Ipsos MRBI on behalf of Bord Bia has show a significant increase in the value of the market by 22% when compared with similar research carried out two years ago. The overall gardening market is now valued at €631m. Bord Bia has been tracking the gardening market since 2001, and 2014 is showing the first levels of increase in the value of the market since the economic downturn six years ago.

The data on the gardening market is collected in a continuous consumer survey among the adult population in Ireland whereby 1,000 representative adults are interviewed during 16 survey periods across the full year.

The reporting context of the 2014 research included:

● The population has grown by 20% since 2001. Currently, the population is increasing only at a marginal rate, due to high levels of emigration (82,000 in 2014). The population is aging considerably, and over 65’s could treble in the next 30 years, according to the CSO.

● Unemployment now stands at 10.6% from a low of 4% just ten years ago but is down significantly compared with 2013.

● New housing unit completions peaked in Ireland in 2006, but only about 8,000 private houses were completed in each of the last three years.

● Inflation (CPI) averaged less than 1.0% in 2014.

Consumer confidence is certainly on the rise, having been on an upward trend since the middle of 2013. This is resulting in a release of cash by consumers, leading to increased car sales, and increased numbers of cash buyers of properties.

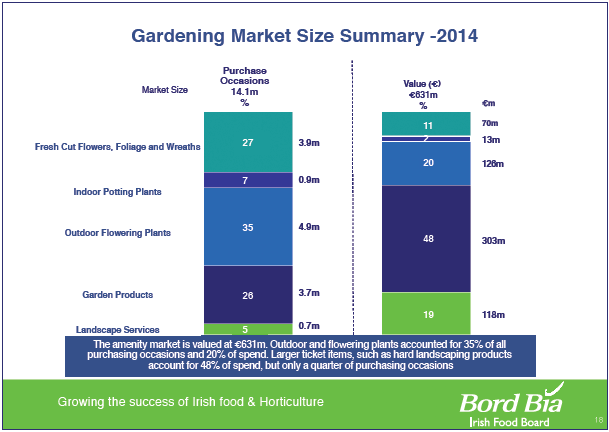

The research divided the gardening market into five distinct categories:

● Fresh cut flowers, foliage and wreaths

● Indoor potted plants

● Outdoor flowering plants

● Garden products

● Landscaping services

The chart below illustrates how each of these categories contributes to the value of the overall gardening market of €631m. The outdoor and flowering plants category is now valued at €126m which makes up 35% of all the purchasing occasions and 22% of spend. In contrast, while the garden products category which contains many of the big spend gardening items makes up 48% of the spend, it makes up only a quarter of the purchasing occasions.

| The chart below provides an overview of how the gardening market has performed over the period since the economic downturn. At the height of the boom, the gardening market hit the €1bn value mark, following which the subsequent collapse in the property market and consumer confidence saw it halved in value by 2012. However, since then the market has started to recover with the research in 2014 confirming a growth in value of 22% since the last measure in the 2011/12 period. |

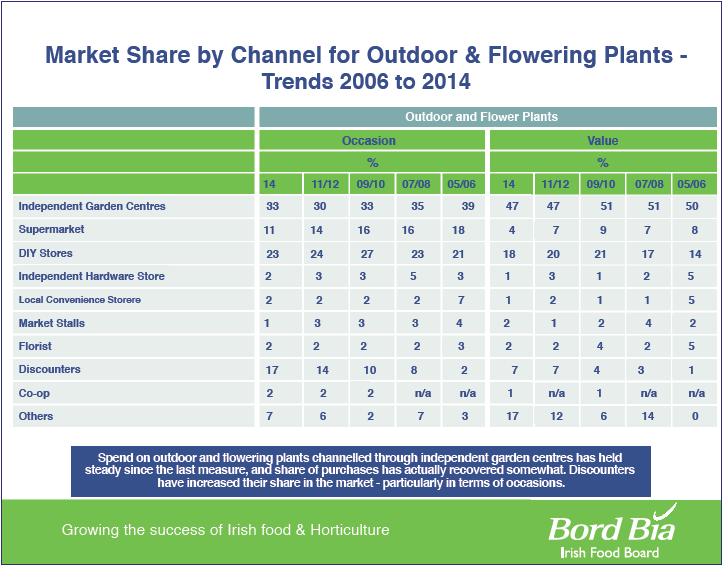

| The gardening market is serviced by a range of channels with the key outlets being the independent garden centres and the DIY stores who have a 50% share of the overall market. But when one looks specifically at the market share for the outdoor and flowering plants category it highlights that the independent garden centres are the most important outlet with a 47% value share of the market and 33% of all purchase occasions. The DIY stores have an 18% value share and 23% of all purchase occasions. |

SUMMARY HIGHLIGHTS FROM THE RESEARCH FOR EACH CATEGORY

Outdoor and flowering plants summary

The outdoor and flowering plants market is worth €126m. This is a 13% increase in value and 20% increase in purchasing occasions since the 2011/2012 measure.

There has been long-term sustained growth in value in two products – hanging baskets/pre-planted containers and herbs, fruit and vegetables for planting. In the shorter term, it is the other products such as bedding plants and bulbs and flower seeds which have enjoyed increased levels of spending.

A combined spend on trees, shrubs and hedges had expanded significantly between 2005 and 2007. However, the market has declined since then, correlating with the sharp reduction in new housing completions and other economic changes. Nonetheless, a small recovery in this area also appears to be happening, primarily driven by increased purchasing occasions.

Indoor potted plants summary

● The value of the indoor potted plants market is now €13m.

● Average spend per purchase has declined since 2011/12.

● Supermarkets hold the largest share of the indoor potted plants market, just ahead of independent garden centres and DIY stores.

● A quarter of all purchases of indoor potted plants are a gift or special occasion related.

Fresh Cut Flowers & Wreaths

● Fresh cut flowers and wreaths are worth €61m – the majority of which is comprised of fresh cut flowers (€50m).

● The value of cut flowers has held at €50m since the last measure in 2011/12, but purchasing occasions are back slightly.

● Discounters account for 31% share of all purchasing occasions for cut flowers (as do supermarkets) compared with only a quarter of purchases being channelled through florists.

Garden Products

● The total value of this category is €305m.

● Purchasing occasions are demonstrating growth but per capita spend has not kept pace.

● The share of purchase occasions is unchanged when compared with 2011/12, with DIY stores dominating across certain products. Independent garden centres have a relatively higher share of purchasing occasions for garden treatments, peat/bark and soil products and paving and decking.

Landscaping Services

● The landscaping market is worth €118m as measured by consumer spend. Spend is spread across maintenance and more specific design/makeover requirements, though 7 in 10 spend occasions related to maintenance.

| This research certainly provides evidence that slowly but surely consumer confidence is returning and given the opportunity and encouragement consumers will spend money on gardening. Hopefully, these are the real green shoots we have been hearing about. ✽ |