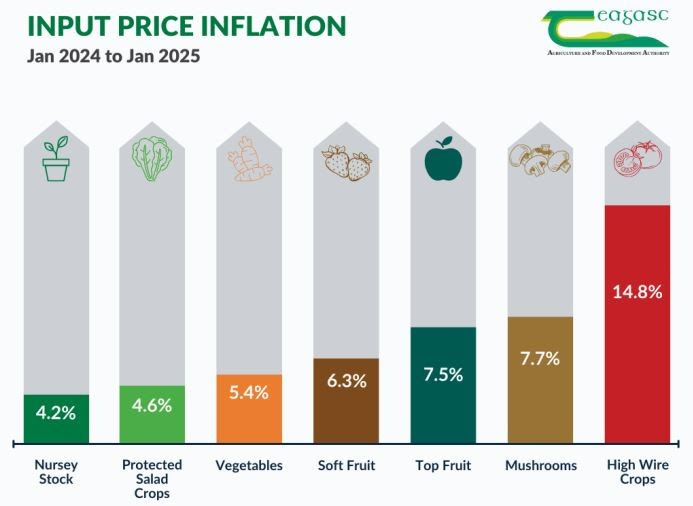

The key objective of this report, as with previous reports is to surface up to date facts about specific inputs price increases now compared to March 2024. We are taking a snapshot of input prices now in order to assess the increases in costs of production for this season. This is an important exercise, as prices negotiated now for product delivered in 2025 will need to reflect these increases. Obviously, certain inputs are specific to enterprise type. The report takes account of the most important and the relative importance of inputs to the different sectors of horticulture production arriving at average increases in input prices in each sector for 2025. Finally, it speaks to the current and potential impacts of very high input prices for primary producers now and for the rest of 2025 season. This is now the fifth report of this type, first produced in 2021. Inflation for nursery stock ran at 4.2% and reflects the increase in labour costs but overall slowing of input costs.

Key findings include

Since the first report of this type in 2021, combined horticultural inputs have risen by an average of 51% and increases range from 36% – 76% across horticultural sub-sectors.

In 2025, labour which accounts for 42.6% of the input costs in horticulture, has contributed significantly to overall input price inflation in the sector.

Margin over costs for primary producers will need to improve, as well as longer-term sourcing agreements to incentivise investment and allow generational renewal of businesses.

Investment from the sector to reduce the reliance on labour and the impacts of climate events will require a market response to ensure the economic and environmental sustainability of Irish horticultural production into the future.

Technologies to reduce the reliance on labour are beginning to be trialled in some key horticultural sub-sectors, however, the financial cost of these technologies is significant and availability is likely to be limited in the short to medium term. These investments will need to be supported.

The sourcing of labour continues to be a significant challenge. The sector needs to avoid a gap between the availability of labour and the availability of labour-saving technologies.