Daniel Uzice, MSc Food Design Innovation, Bord Bia – Irish Food Board

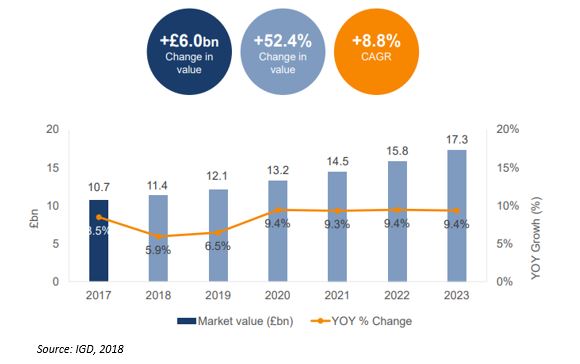

With all the talk around omnichannel, internet of things, robotics, AI and augmented reality, sometimes we simply become overloaded with the wealth of information and innovation happening in the online space, taking our attention away from the bigger piece of the pie (Bricks & Mortar). While online is set to see significant growth as a channel estimated to be worth over £17 billion in the UK by 2023, you must first consider: How do shoppers shop my category online?

Commodities:

Online will always have some level of importance to your category. Even looking at low engagement/commoditized categories, we can see brands are already reaping the benefits. Simply take a look at how amazon pantry makes it easy to reorder simple products in bulk or on a subscription basis. From toilet paper or toothpaste to washing detergent, brands that play in this arena can really leverage the power of online driving loyalty and steady sales.

Vice & Virtue:

According to a study conducted by Hughes et al (2017), shoppers make fewer vice purchases online compared to shoppers in stores. Is your product a vice or a virtue? What I mean by that is where your product fits within the consumer/shopper’s mind? Do they see your product as something that is, for example, healthy or indulgent? This is a very relevant question for any brand that is considering a growth strategy for an online channel.

Sensory Experiences – In Store:

But why does this matter? Let’s basically put it down to sensorial experiences and subconscious drivers. In a store, a shopper takes in merchandise, scents, impressive blocking of categories/brands, lighting, music and so on. These all add to the shoppers’ experience (nothing new there). Shoppers can thus see your product, pick it up, inspect it and in some cases, taste it (trial). All these sensorial experiences help them imagine how your product will taste or perform, and thus shoppers build a mental image of the product once cooked, opened, or consumed.

Symbolic Representation – Online:

However, online, shoppers generally see static images thus products are presented symbolically. The shopper cannot touch, feed, taste, inspect the product, therefore, they make fewer choices based on emotion and more based on logic. So, let’s say your product falls under the vice purchase category (perhaps indulgent, not very healthy, but still very attractive/desirable). Noted by Huyghe et al (2017), affective and visceral responses (shoppers’ emotions and reactions when decision making) tend to override will power (logic and reason) in store when they come across your product – they are thinking of taste, enjoyment, satiation, the occasion etc.

Now let’s look at a vice purchase within an online channel “where products are presented symbolically” which creates a sensorial distance between product and shopper (Huyghe, 2017). Shoppers can thus only see the static product shot on the web page and not a 360 view. Furthermore, they cannot touch it, trial/taste it there and then, and finally (but most importantly), they cannot imagine how the product will taste/perform to the same extent one would when interacting with the physical product in the store.

This is not an easy fix either. First off, most grocery retailers use simple product pages which includes the pack shot (generally a photo of the front of the pack) and the items description so it may be difficult (not impossible) to direct retailer online strategies to further develop product pages beyond their current state. Additionally, features such as favorites and saved shopping lists further reduces impulse purchases. However, you can invest in online – utilize paid banners, advertising to paid shopping list items and targeted search terms. While online seems attractive, you must invest time and resources into developing it as a channel for your range. Particularly for new or challenger brands, winning in this channel will require some thinking outside the box.