Mike Neary, Manager of Horticulture with Bord Bia, summarises recent positive research results on Ireland’s foodservice market

Over the past three years, Bord Bia has commissioned new research and insights on the Irish foodservice marketplace. Deep dive insights on the quick service restaurant (QSR)and

food-to-go markets were published in 2015 and a broader assessment of the entire foodservice market was published in 2014 and 2016. Last year, in addition to Bord Bia’s insight research around the entire foodservice sector, research on produce (including fruits,

vegetables and potatoes) in Ireland was also carried out.

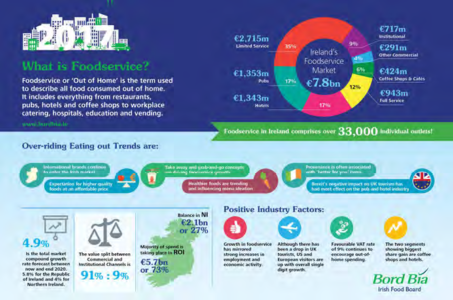

The infograph summarises the foodservice market in Ireland in 2017. Out of a total

consumer spend of €7.8bn on the Island of Ireland some €5.7bn occurs in the ROI.

THE APPROACH TO THE RESEARCH INCLUDED THE FOLLOWING:

- One-on-one trade interviews with knowledgeable persons in companies throughout the

foodservice supply chain, including foodservice operators, distributors, trade associations and suppliers. - Data collection from numerous secondary sources

LEADING MARKET FACTORS IMPACTING THE OVERALL IRISH FOODSERVICE MARKET – 2017

● Continued strong economic performance

● Generally strong tourism statistics

● Continued growth in employment and exceptional growth in the tech sector

● Uncertainty over the ultimate impact of Brexit

● Tight labour markets create shortages and challenges in staffing

● Favourable VAT rate continues to encourage out-of-home spending

OVERALL ASSESSMENT OF THE FOODSERVICE INDUSTRY 2017

In 2017, Irish consumers spent €7.8 billion on out-of-home food and beverage across the island of Ireland. Most consumer spending (approximately 91%) occurs in commercial segments, including quick-service restaurants, co ee shops and cafés, full-service restaurants and pubs. A lesser amount (approximately 9%) is spent in the noncommercial

segment, which includes business and industry, education and healthcare, among others.

Growth in foodservice has mirrored strong increases in employment and economic activity, and foodservice within the Republic of Ireland has continued to expand as underlying

economic conditions remain positive. The current growth of 5.8% in the Republic for all of the foodservice confirms that the industry remains healthy and robust, and the €5.7 billion

consumer spending is the highest level reached over the past several years.

In the past, Northern Ireland underperformed relative to the South, and while growth in the North remains somewhat soft, figures developed for this study indicate that there has

been an acceleration in foodservice in the North, particularly as the economy and tourism in large markets such as Belfast have accelerated.

35% of consumer spending in the commercial channel is found in limited service restaurants (LSRs), with only 12% attributed to full-service restaurants (FSRs). Pubs account for 17% of spend (excluding alcohol). The two segments showing the biggest share gain are the co ee shop/café segment, accounting for 5% of total commercial spend, and the hotel segment, accounting for 17% of total foodservice consumer spending.

Within institutional foodservice, growth is more subdued but still healthy. Business and industry are the category leaders, accounting for 42% of the institutional market. Healthcare is also a large player in the field, with hospitals and other healthcare facilities accounting for 32% of institutional consumer spend.

OVERVIEW OF DRIVING FACTORS – KEY TRENDS IN THE PRODUCE AND POTATO CATEGORIES/SUPPLY

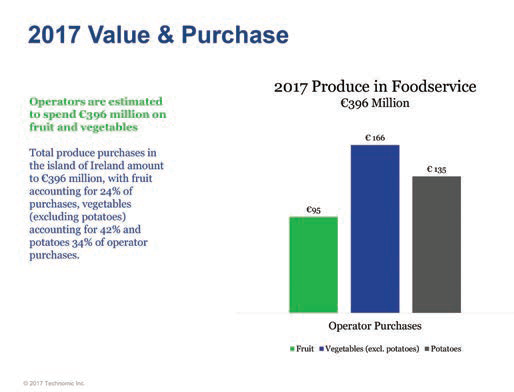

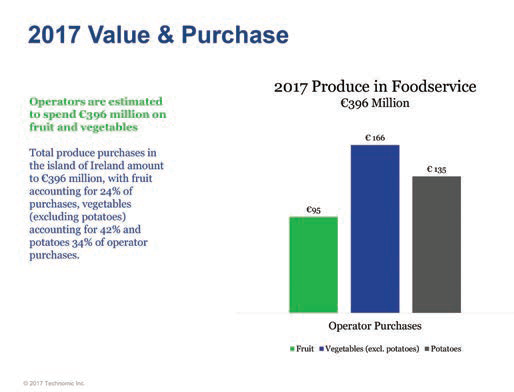

In 2017 foodservice operators purchased just under €400m worth of fruit, vegetables and potatoes. These include fruit at €95m, vegetables at €166m and potatoes at €135m.

BROADLINE DISTRIBUTORS DISRUPT PRODUCE AND POTATO SUPPLIERS

Broadline distributors continue to capture more business with Irish operators. These larger distributors are able to o er a one-stop shop solution by providing a wider variety

of product categories as well as a larger distribution reach. In addition, many produce suppliers have already or are considering supplying to these broadline distributors rather than working directly with operators. However, there is still a demand among select operator groups for a direct relationship with local, specialised suppliers.

LOCAL SOURCING /LOCAL SUPPLY

Despite the challenge with sourcing fruits, vegetables and potatoes locally year-round, the majority of operators support the initiative. Operators often source locally whenever possible for as many months out of the year as their suppliers can feasibly manage. Both consumers and operators believe this initiative is important. However, there has been a decrease in the number of Irish growers over the last few years with overall consolidation in the supply base.

THE POTENTIAL IMPACT OF BREXIT ON TRADE

The threats of Brexit include the potential impact on trade, tariffs, movement of produce and currency rates.

HEALTHY EATING TREND PROMOTES THE CONSUMPTION OF PRODUCE

With the island of Ireland increasingly concerned with combating obesity and encouraging healthy eating, fruits and vegetables are primed to grow in popularity among consumers

and operators. The produce category is especially poised for growth now that fruits and vegetables have been repositioned as the most important food group on the food pyramid.

INCREASED OPERATOR NEED FOR CONVENIENCE PRODUCTS

Operators, suppliers and distributors reflected in the research an increase in the operator demand for pre-prepped (e.g., pre-peeled, pre-cut, pre-washed) produce and potatoes. This trend is largely due to the labour shortage in Ireland, namely skilled culinary staff. Operators are also increasingly seeking out prepared and mixed vegetables for soups, salads and other dishes. As a result, suppliers are deepening their product line-up with additional convenience products. ✽

|